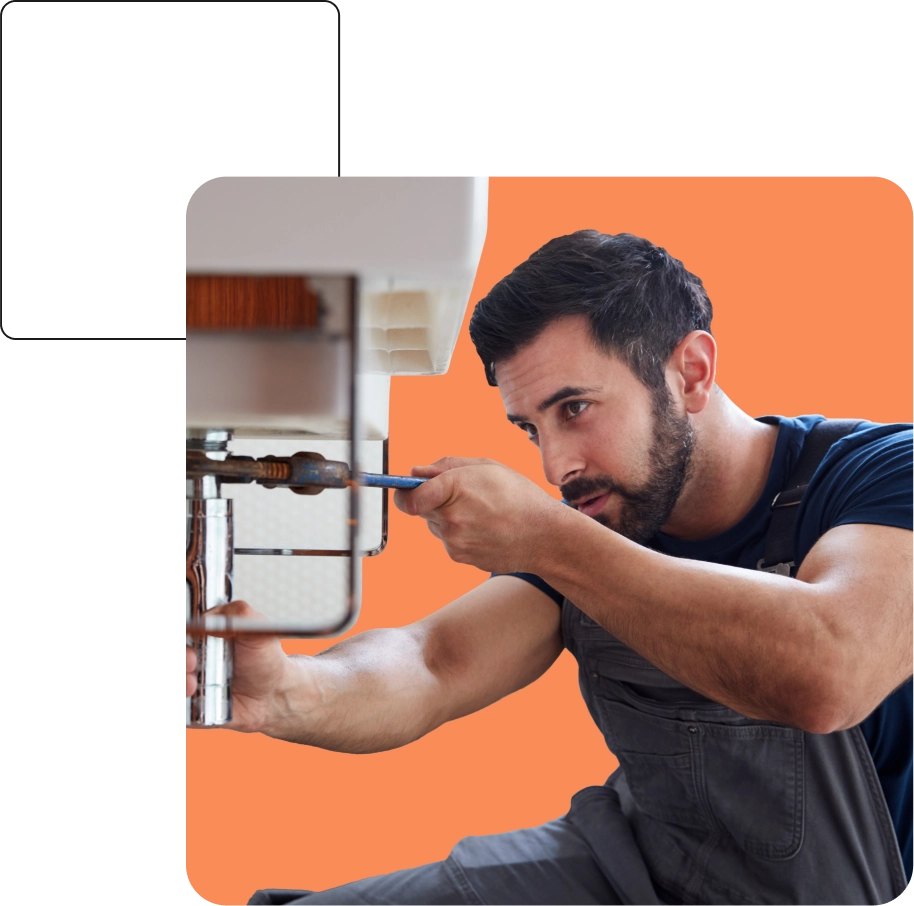

Plumbing businesses in Victoria face a range of risks, from water damage to property claims and personal injuries. We offer tailored Plumbers Insurance in Victoria, including comprehensive Public Liability Insurance for plumbers operating in Melbourne and throughout the state. Our policies are built specifically for licensed plumbers who need reliable protection while meeting Victorian industry regulations.

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Most Dedicated Business Insurance Broker 2023

QLD 2023 Top Insurance Broker Finalist

Peoples Choice 2023 Winner

Fast Starter Award 2023

QLD Top Insurance Broker Finalist 2022 Finalist

QLD 2022 Top Insurance Broker Finalist

Top Thought Leader 2022 Winner

Depending on the state you’re in the first plumbing insurance policy that you will need to consider is plumber public liability insurance. This policy will usually be required to be in place and proof of insurance will be requested when applying for your plumbing license.

We can provide you with all the documentation that you need to meet your insurance requirements of your plumbing license. We also have a good understanding of what’s required state by state so regardless of where you are in Australia, from Perth plumbers to Victorian plumbers, our team of plumber insurance brokers can help you.

The most common insurance for plumbers are:

Depending on the state you’re in the first plumbing insurance policy that you will need to consider is plumber public liability insurance.

This policy will usually be required to be in place and proof of insurance will be requested when applying for your plumbing license.

We can provide you with all the documentation that you need to meet your insurance requirements of your plumbing license.

We also have a good understanding of whats required state by state so regardless of where Victoria you are our team of plumber insurance brokers can help you.

We’ve worked with enough plumbing contractors to know the value of your equipment.

Things like drain cameras, jetters and Rothenberger press tools are expensive and should be insured as part of your plumbers insurance program.

Portable tools insurance is typically a cheaper alternative than having to replace these items if they were ever lost or stolen.

There are two different ways you can insure your tools. You can either list each item that has an individual value over $3,000 or take out a dollar value of cover that will only cover up to $3,000 per item.

We can work with you to tailor a structure that meets your financial situation.

A mobile business like a plumber drives around in their office everyday from site to site.

Your vehicle and it’s set up is usually a very important part of your business.

If you’re purchasing your motor vehicle insurance through an online quoting insurer then there is a good chance that your cover probably isn’t as high as it should be.

Things like vehicle wraps, signage, shelving and tool box fit outs are only covered for low values on standard policies.

Make sure you have enough plumbers insurance cover and speak with one of our insurance brokers to be covered correctly.

After dealing with hundreds of plumbing contractors over the last few years we know that plant and equipment insurance is an important part of your business.

Whether you own an excavator or only hire one on occassions a plant and equipment insurance policy will provide you cover for your various machines.

We specialise in placing policies like blanket hired in plant cover that gives you the flexibility to have an annual insurance policy that covers the various different machines you hire during the whole year.

We know you know that income protection is important for you, your business and your family.

We aren’t going to take up all of your time on smoko and bore you with all the details about income protection insurance.

The important thing to know is that a lot of plumbers dont consider this when putting their plumbing insurance policies in place.

Let’s have the chat, get the information that we need and we can take care of the rest for you. We like making things simple.

Plumbers in Victoria frequently operate in environments where the risk of accidental property damage is high. Public Liability Insurance protects you from the financial fallout if something goes wrong while working in homes, retail spaces, or on new construction across Melbourne and beyond. Scenarios can include a burst pipe during installation causing water damage to a neighbouring business, drilling into a wall and hitting concealed services, or damaging tiled surfaces during bathroom renovations. Having appropriate cover means you can continue operating without absorbing large out-of-pocket costs for accidental damage.

The job often involves interacting with clients, other trades, or members of the public—especially on worksites in densely populated areas like inner Melbourne. If someone is injured due to your tools, equipment, or job site conditions, you may be held liable. Public Liability Insurance provides coverage for legal fees, medical costs, and compensation if a third party suffers harm. Whether someone slips on water during a job or is injured by unsecured materials, the right policy ensures your plumbing business remains protected and compliant with Victorian laws.

Most states across Australia will require you to supply a copy of your public liability insurance in order for you to obtain your plumbing license.

If you’re in Victoria however, you do require an inclusion on your policy for plumbers warranty insurance.

We automatically include this whenever we speak with plumbers located in Victoria so you don’t need to be concerned whether your policy is compliant or not when purchasing through our brokerage.

Definitely not, we speak with plumber regularly about their insurance policies and we have seen some big differences in the work that a plumber does and what their policy actually covers them for.

A common thing we come across is a policy that only covers domestic plumbing work and the actual business does a lot of commercial type work.

Most plumbers are very surprised when we bring this to their attention and they realise the risk that they have carried for the last number of years.

Yes, you should consider plumber public liability insurance as a necessity if you are in the business of plumbing. Your clients may hold you responsible for any damage that your work causes to their property. In addition, if someone is injured while on your property or as a result of your work, they may sue you for damages. Plumbers insurance can help protect you from financial ruin in the event that you are sued or held liable for damages.

Plumbers insurance typically covers two main types of risks: third-party bodily injury and property damage, and first-party business interruption. Third-party coverage protects you from claims made by other people, such as your clients, for bodily injury or property damage that you are held liable for. First-party coverage protects you from financial losses that your business may suffer as a result of an interruption in your operations, such as if your office is damaged by a fire.

Plumbers may require a professional indemnity insurance if they are issuing any certification or compliance certificates.

For example, if you are issuing gas compliance certificates than a professional indemnity insurance policy should be considered.

Another component that may require professional indemnity insurance is if you are provided design services for a fee.

This is something that we cannot answer broadly and depends on your business, your risk appetite and how your business operates.

The most frequent policies that we put in place for plumbers are:

If you would like to see a more comprehensive breakdown, view our article on what insurance do plumbers need.

Yes, your public liability insurance covers your business in its entirety.

This means that if your business is held liable and the damages fit within the scope of your cover then if it was caused by an employee or apprentice then it would be covered.

If the damages were caused by a sub-contractor, they are not considered employees and would be treated differently in the event of an insurance claim.

The cost of plumbers insurance depends on a number of factors, including the type and scope of coverage you purchase, the size and location of your business, and the amount of risk you present. Talk to Priority today about the needs of your business and we can give you a clear picture of what coverage tailored to you would look like.

Ready to speak with someone?

© 2023 Priority Insurance Brokers. All Rights Reserved. | DCSX Group Pty Ltd T/

As Priority Insurance Brokers | ABN 95 655 563 616 | ACN 655 563 616 | CAR

1295220 Authorised representative of Community Broker Network Pty Ltd |

AFSL 233750 | ACN 096 916 184