We specialise in insurance for roofers including domestic, commercial and industrial roofing companies.

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Most Dedicated Business Insurance Broker 2023

QLD 2023 Top Insurance Broker Finalist

Peoples Choice 2023 Winner

Fast Starter Award 2023

QLD Top Insurance Broker Finalist 2022 Finalist

QLD 2022 Top Insurance Broker Finalist

Top Thought Leader 2022 Winner

After working with a large number of roofing contractors over the last couple of years we know what insurance policies that you need to make sure you’re covered correctly. We specialise in tailored insurance policies for all types of roofing contractors so whether you are doing domestic roofing, commercial or even industrial roofing we can manage it all for you.

Insurance policies for roofing contractors are typically:

If your business is involved in any form of high risk occupations, we work with a number of insurers and underwriting agencies that offer tailored cover for roofing businesses and contractors.

Roofers insurance policies are typically subject to a long list of exclusions and endorsements so it’s important to know that you’re getting the right advice in relation to your policies.

No matter how careful you are and how long you’ve been operating there is always the chance that something unforseen could happen. If you do not have a suitable roofers insurance policy than there could be a number of potential exposures that may or may not be covered.

We focus on providing our clients with expert advice, quality policies and clearly explain the fine print so that our clients are confident in the cover that we have placed for them.

We understand that running a business takes a lot of work and as a business owner you’re expected to be across all of the different aspects of your business operation. We have tried to make our process as simple as possible and all of our Brokers work with each business owners to have a strong understanding of your business and whats required to be in place to ensure that there are no nasty surprises. We pride ourselves on not hiding behind the fine print.

Imagine a client contacts you, lets you know that they have had water ingress come into their property and that they believe is from a number of screws not tight enough an a small gap showing between the roof sheets.

You go through the process, ensure your client that you will have it rectified and then contact your current insurance broker. Your current insurance broker then advises you that your current policy has a $10,000 excess for water damage claims. You weren’t aware of this excess and unfortunately have to pay this excess for the claim to progress.

A tailored roofing contractors insurance policy will outline any endorsements that have been applied along with any higher than normal or special excesses that have been imposed.

We ensure that all of our clients are aware of their policy coverage and the conditions that apply.

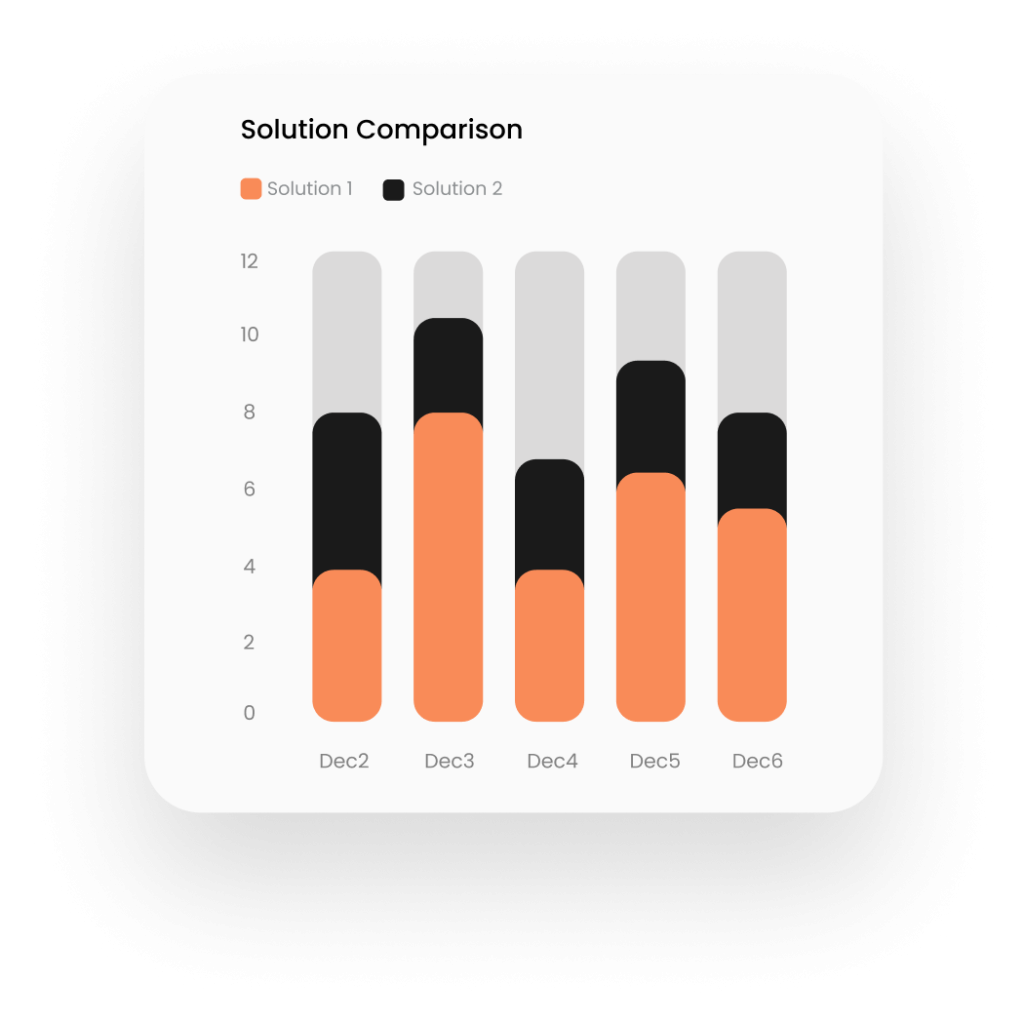

As an Insurance Broker, we specialise in packaging up multiple policices which present the best priced options but having them managed together in easy to maintain policies.

Roofers typically require a combination of insurances to protect against the various risks associated with their trade. Essential coverages include public liability insurance, which covers potential third-party injuries or property damages, and personal accident and illness insurance. Depending on the services offered, they might also consider professional indemnity insurance and tools or equipment insurance.

Like with most trade occupations, working on any physical structure can have a significant loss that you could be responsible for. Some of the most common claims that we see for roofing companies are water ingress from exposed screw holes or loose screws. This typically leads to a significant loss where internal ceilings have been compromised and need replacing.

Roofers insurance typically provides coverage for third-party injuries or property damage resulting from the roofing work (public liability insurance). Depending on the policy, it might also cover personal injuries or illnesses (personal accident and illness insurance), claims arising from professional advice or services (professional indemnity insurance), and potential loss or damage to tools and equipment. As always, it’s essential to review the specifics of any policy to understand its inclusions and exclusions.

There is no particular insurer that is “the best” for a particular industry. It is better to work with your broker to ensure that your policy is the best for your needs. For example, some policies have height restrictions which may be great for a residential roofing company but not suited for a commercial roofing company. It is up to your broker to have a strong understanding of the business that you are doing to ensure that your policy is the most competitive option available to your business without reducing your cover.

Public liability, tools insurance and vehicle/trailer insurance is usually the most common.

Working with your broker is the key to getting the right policy for your business. Insurance brokers are familiar with industry exclusions that could be missed if done on your own.

Ready to speak with someone?

"*" indicates required fields