We are a business insurance broker that prioritises you and your business. We have built our brokerage on trust, honesty, and dedication to our clients.

Backed by Australia’s largest broking group, Steadfast, which gives our clients access to competitively priced policies and bespoke policy wordings.

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Professional

tailored advice

Competitively

priced policies

Comprehensive

cover options

Steadfast Broking Group Member

Our network has access to bespoke policies only available through a Steadfast business insurance broker

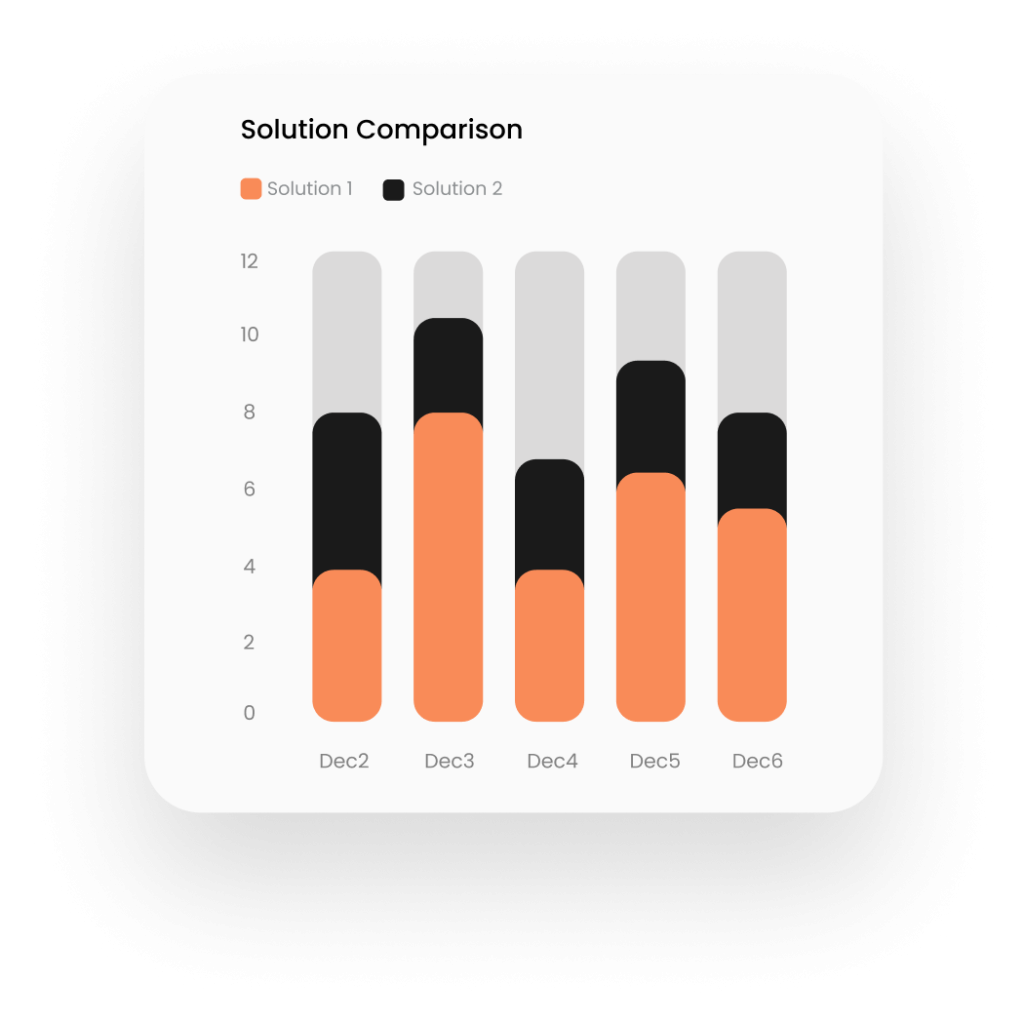

We take care of all the research and comparisons to ensure that you get a competitive insurance solution that meets your business needs.

Our team of business insurance brokers is dedicated to providing your business with tailored advice with your best interest at the forefront of everything we do.

We work with our clients to reach a mutual goal of comprehensive cover with the affordability factor being a strong motivator. If you’re looking to work with a business insurance broker that prioritises your needs and works with you to obtain those goals then we can’t wait to work with you.

We take care of all the research and comparisons to ensure that you get a competitive insurance solution that meets your business needs.

Our team of business insurance brokers is dedicated to providing your business with tailored advice with your best interest at the forefront of everything we do.

We work with our clients to reach a mutual goal of comprehensive cover with the affordability factor being a strong motivator. If you’re looking to work with a business insurance broker that prioritises your needs and works with you to obtain those goals then we can’t wait to work with you.

Expert Risk Management Advice

No sitting on hold, ever. Speak to a real business insurance broker that can assist you with tailoring an insurance package to your business.

Our network has access to bespoke policies only available through a Steadfast business insurance broker

No sitting on hold, ever. Speak to a real business insurance broker that can assist you with tailoring an insurance package to your business.

Need a Business Insurance Broker?

We've got you covered.

We can arrange small business insurance whether you’re

a small business owner just starting out or even in the planning

stages. We work with businesses of all sizes.

We provide tailored insurance packages for corporate clients.

As experienced commercial insurance brokers, our broking

group has the facilities to provide solutions to large, complex

organisations

Founder at Backtracks - Jonathan Hill

CEO of ABC Company - Natalie Fernandez

Founder at Backtracks - Jonathan Hill

CEO of ABC Company - Natalie Fernandez

As a commercial insurance broker, we provide all of our clients with easy access to one of our dedicated insurance brokers, ongoing management of insurance policies, end to end claim services and acting on your behalf with insurers. If appointed as your business insurance broker, we ensure that we always act with your best interest at the forefront of everything we do.

If you keep on getting bounced around to different account managers with your current business insurance broker this causes gaps in understanding your business and covering it correctly. We take pride in building relationships with our clients and will always prioritise keeping you with your dedicated advisor.

We never provide advice based on sales targets, we work with you to outline your desired risk tolerance. We tailor our insurance packages to provide you with the optimal balance between your exposed risks and your budget. We have extensive experience in showing you ways to reduce your premium without reducing your cover.

By using a commercial insurance broker this allows you to get back to the things that you need to do to keep your business operating and earning income. We usually require about one hour of your time to be able to assess your current policies, provide advice and then present you with a suitable solution.

We ensure that your assets are protected whether that be your property, motor vehicles or your company operation. we take the time to understand your situation and tailor our recommendations accordingly. Insurance is never a one size fits all therefor, all of the advice we provide is tailored specifically to your business.

If you keep on getting bounced around to different account managers with your current business insurance broker this causes gaps in understanding your business and covering it correctly. We take pride in building relationships with our clients and will always prioritise keeping you with your dedicated advisor.

We never provide advice based on sales targets, we work with you to outline your desired risk tolerance. We tailor our insurance packages to provide you with the optimal balance between your exposed risks and your budget. We have extensive experience in showing you ways to reduce your premium without reducing your cover.

By using a commercial insurance broker this allows you to get back to the things that you need to do to keep your business operating and earning income. We usually require about one hour of your time to be able to assess your current policies, provide advice and then present you with a suitable solution.

We ensure that your assets are protected whether that be your property, motor vehicles or your company operation. we take the time to understand your situation and tailor our recommendations accordingly. Insurance is never a one size fits all therefor, all of the advice we provide is tailored specifically to your business.

Priority Insurance Brokers takes great pride in making sure that we deliver great value to our clients. Our insurance solutions focuses on providing you value for money with cost effective policies that are tailored to your industry. We take a hands on approach in working with our clients that allows us to understand your business, how it operates and what your exposure points are. We never consider our clients as just a number regardless of how big or small your business is.

Whether you need a small business insurance policy, insurance for a sole trader or protection for a larger commercial operation, our team of business insurance brokers will provide you with cost-effective and comprehensive insurance solutions. Regardless of where you are located, we have a team ready to assist you.

Our specialist brokers are ready to assist you and although we do not offer an immediate quote online there is an important reason why.

Most insurers that offer immediate online quotes are designed to sell you their most profitable policies hidden by pages and page of fine print. Our brokers know what to look out, what is included in the policy wordings and how it affects you when you need to make a claim.

In most circumstances, we can turn around quotes extremely quickly, usually on the same business day. This allows us to take a competitive approach and review the quoted policies thoroughly.

We can quote Business Package insurance policies, Public Liability insurance, commercial truck insurance all on the same day. Depending on the level of complexity, we can also get instant quotes for Professional Indemnity policies with a 1-2 business day turn around.

In most circumstances, we can turn around quotes extremely quickly, usually on the same business day. This allows us to take a competitive approach and review the quoted policies thoroughly.

We can quote Business Package insurance policies, Public Liability insurance, commercial truck insurance all on the same day. Depending on the level of complexity, we can also get instant quotes for Professional Indemnity policies with a 1-2 business day turn around.

I never thought I would say organising insurances was easy and stressful, however working with Josh at Priority Insurance Brokers was a pleasure. So helpful, and so easy to deal with.

Josh from Priority Insurance Brokers was a pleasure to deal with. Easily contactable for any questions or concerns I held about my insurance queries. I look forward to dealing with them for all our business needs.

Daniel has been absolutely fantastic and prompt in dealing with our commercial vehicle insurance and now our Public Liability and business insurance needs. I would highly recommend Daniel & the team for your insurance needs - no fuss, diverse options and found us the lowest premium to suit our needs.

Found us a good deal on our Public Liability Insurance. It's worth a quote from them.

I partnered with PIB earlier this year as I was in need of updating my business insurance in order to provide more coverage. The customer service I received from Dan, was extremely professional and exactly what I expected. Every time I have needed to make amendments to my policy, the process was completed promptly and communicated to me in a way that put my mind at ease. I absolutely recommend the team at PIB for any of your insurance broker needs. Well done team!

From start to finish this was the quickest and most painless insurance process for my new business. Daniel was absolutely fantastic and was able to provide me with a detailed explanation of the policies and had an in-depth knowledge of the insurance in my industry. I would definitely recommend Priority Insurance Brokers to anyone looking for stress free Insurance. Thanks again

Struggled for weeks to get Demolition added to my current liability insurance in order to submit for a licence application. Found Priority and within a day Dan had a quote, an acceptance and fully paid up insurance with a certificate of currency. Saved me so much stress and time. Thank you again

Efficient and timely. Insurance requirement for a niche business. All members of Priority Insurance Brokers were great to deal with and the insurance premium was very competitive. Special thanks to Daniel

Mining insurance - easy process and fast turnaround. Good communication all the way through. Exactly the service you want for quick site mobilisation. Highly recommend

Hi, Thanks for your help and support, very helpful team and cooperative. Regards, Falah Emu Demolition

Very prompt and competitive pricing.

Daniel Ufer (authorised representative 1295221) is the Managing Director of Priority Insurance Brokers, bringing seven years of industry experience. Specialising in blue collar, trades, construction, and mining insurance, Daniel holds a Diploma of Insurance Broking and is a Qualified Practicing Insurance Broker.

His dedication and expertise were recognised in 2023 when he was awarded the ADVISR Insurance Broker of the Year (People's Choice). At Priority Insurance Brokers, Daniel leads the company while managing key accounts, ensuring top-tier service and tailored insurance solutions for clients in demanding industries.

Chloe Ufer is a Director at Priority Insurance Brokers with seven years of experience in the financial services industry. She specialises in accounts and administration, holding a Bachelor of Laws, a Graduate Diploma in Legal Practice, and RG146 certification in superannuation. Chloe has previously worked with Sunsuper and various law firms. At Priority Insurance Brokers, she manages accounts payable, staffing, and compliance. Recently returning to the workforce after taking time off to raise her three children, Chloe now contributes significantly to the company's strategic planning and growth, leveraging her extensive legal and financial expertise.

Joshua Cotter (authorised representative 1313037) is an Account Manager at Priority Insurance Brokers with 16 years of industry experience. He specialises in blue collar, trades, and mining insurance. Joshua holds a Diploma of Business, an Associate's Degree in Education, and Tier 1 RG146 Insurance Broking certification. He has worked with major brands within the Suncorp Group and Youi Insurance, where he was recognised as Best Insurance Leader. At Priority Insurance Brokers, Joshua is dedicated to helping clients achieve the best insurance outcomes. Apart from a brief stint in a supermarket during his teens, his entire career has been devoted to the insurance industry.

At Priority Insurance Brokers, Jermelyn is known for her exceptional ability in providing support and delivering swift service to ensure smooth operations and is also well organised enhancing the productivity within the organisation. She’s able to manage time effectively to meet tight deadlines while looking at every perspective to deliver high-quality results.

Business insurance is important for businesses because it helps protect them from financial losses that can occur as a result of risks such as accidents, fires, theft, or lawsuits. Without business insurance, a business could be forced to close its doors if it had to pay for damages or injuries out of its own pocket.

There are many different types of risks that businesses need to insure against, but some of the most common include:

The cost of insurance for a business depends on a number of factors, including the size and type of business, the amount of coverage the business needs, and the location of the business. Contact a Priority IB insurance broker today to talk about your business needs and find out information more relevant to your case.

Whether you need a small business insurance policy, insurance for a sole trader or protection for a larger commercial operation, our team of brokers will provide you with a cost effective and comprehensive insurance solution. Regardless of where you are located, we have a team ready to assist you.

Most insurers that offer immediate online quotes are designed to sell you their most profitable policies hidden by pages and page of fine print. Our brokers know what to look out for, what is included in the policy wordings and how it affects you when you need to make a claim.

In most circumstances, we can turn around quotes extremely quickly, usually on the same business day. This allows us to take a competitive approach and review the quoted policies thoroughly. We can quote Business Package insurance policies, Public Liability insurance, commercial truck insurance all on the same day. Depending on the level of complexity, we can also get instant quotes for Professional Indemnity policies with a 1-2 business day turn around.

Why should you use

Unfortunately, most customers who manage their own insurances don’t actually know if a specific insurance product is an “optional extra” or a separate policy in general until they suffer a loss. As a commercial insurance broker our job is to assess the risks associated with your business from our initial discussions, identify them to you and work with you to ensure that you minimise any potential losses to your business operation or personal assets. With each customer, we will put together a recommendation letter which outlines the policies in which we recommend you to consider.

This is a huge advantage to you as a business owner. Who has a spare couple of hours to get quotes for insurance? Let alone review the fine print to ensure that you are covered correctly. The time you spend just to get a quote is only a small portion of the time that you could better use within your business. If a claim was to occur you could be looking at multiple emails, multiple phone calls, endless frustration after speaking with 5 different people and repeating yourself. By using a business insurance broker, you speak directly with us, we manage your claim and your policy and provide advice and updates along the way.

Saving money on your insurance premium is an added benefit that we can provide. We provide this by looking at ways to reduce your premium your existing insurer or by re-marketing your policy with our panel of insurers to achieve a better a result. Saving you money is not guaranteed however, we can also help you save money should an insurance claim occur. We know most policies in and out and from the initial discussion about a claim occuring we can advise you on whats likely to be covered and what expenses are likely to be reimbursed.

Ever had an insurance claim that you’ve lodged and you’ve gotten extremely frustrated and not known what do? By using a commercial insurance broker, should a matter need to be escelated beyond the initial claims team than we can assist in having this escelated. The insurers will usually have their own escelation points however. being part of Australia’s largest broking group we also have our in-house escelation points that can assist with resolving any claim disputes. If you were to handle this on your own, you have limited resources available to you and once again causing you a large outlay of time.

All of our dedicated account managers handle all types of general insurances and therefor your business insurance broker can be your go to person for any enquiries. We also assist in creating a smooth renewal process by having a renewal review discussion or meeting with you, then coming back to you with our recommendations. We can also assist in providing insurance certificates, monthly repayments, risk reviews and mitigation strategies.

Ready to speak with someone?

"*" indicates required fields